Message from CEO

2021 is coming to a close and I am glad to report that the AoF has had a very fruitful year, thanks to your support and participation. Our leadership development and research efforts have focused on and made contributions to key contemporary developments in the financial sector, including fintech and digitalisation, green finance and ESG, and GBA and China. We have also expanded significantly the reach of our events and reports, not only to many more senior executives in the local financial sector, but also to stakeholders outside of Hong Kong, including regional central banks and the audience in Mainland China. The webinar on the RMB exchange rate in August, for example, attracted over 1.16 million viewers and has set a new benchmark for our future efforts in increasing our impact and promoting our brand.

2021 is coming to a close and I am glad to report that the AoF has had a very fruitful year, thanks to your support and participation. Our leadership development and research efforts have focused on and made contributions to key contemporary developments in the financial sector, including fintech and digitalisation, green finance and ESG, and GBA and China. We have also expanded significantly the reach of our events and reports, not only to many more senior executives in the local financial sector, but also to stakeholders outside of Hong Kong, including regional central banks and the audience in Mainland China. The webinar on the RMB exchange rate in August, for example, attracted over 1.16 million viewers and has set a new benchmark for our future efforts in increasing our impact and promoting our brand.

Impact and branding are important because the AoF/HKIMR should aim at making itself a premium platform for informed and insightful discussions on economic and financial issues, particularly those related to Hong Kong, China and this region. This would contribute towards building Hong Kong’s thought leadership as it develops further as a global financial centre.

An important, new initiative we have introduced is the Financial Leaders Programme. This aims to nurture the next generation of top leaders for our financial services industry. I encourage our Members to consider seriously nominating their promising, experienced colleagues to this Programme if you have not already done so.

I wish you a healthy and prosperous 2022, and I look forward to seeing you in coming AoF activities!

Kwok-chuen Kwok

CEO, Hong Kong Academy of Finance

Events

The Eleventh Annual International Conference on the Chinese Economy

The Hong Kong Institute for Monetary and Financial Research (HKIMR) successfully hosted the Eleventh Annual

International Conference on the Chinese Economy (the Conference) on 11 November. Over 3,000 people participated, both online and offline, including many from central banks, international financial institutions, the financial sector,

the academia, and professional institutions.

The Hong Kong Institute for Monetary and Financial Research (HKIMR) successfully hosted the Eleventh Annual

International Conference on the Chinese Economy (the Conference) on 11 November. Over 3,000 people participated, both online and offline, including many from central banks, international financial institutions, the financial sector,

the academia, and professional institutions.

The theme of the Conference this year is “On the Path to Common Prosperity: China’s Economic Development in Dual Circulation”. In his Opening Remarks, Mr Eddie Yue, Chief Executive

of Hong Kong Monetary Authority, highlighted a range of important policy issues of the Chinese economy, including income inequality problems and a rapidly aging population.

During his keynote speech, Mr Long Guoqiang, Vice President of the Development Research Center of the State

Council, elaborated on the policy of common prosperity in depth. He also had a candid conversation with participants on the latest development of the property sector in China.

During his keynote speech, Mr Long Guoqiang, Vice President of the Development Research Center of the State

Council, elaborated on the policy of common prosperity in depth. He also had a candid conversation with participants on the latest development of the property sector in China.

This is the first year that the Conference was conducted in a hybrid format. Around 30 Economists, AoF Members and guests attended the Conference in person.

To watch the video replay of the Conference and find out more insightful views from other speakers

To watch the video replay of the Conference and find out more insightful views from other speakers

Interview Series – Professor Edward Chen

Following the success of Interview Series on “Navigating through Uncertainties and Chaos” last year, AoF proudly presented a brand new episode featuring Professor Edward Chen, Chairman of HKU SPACE in October.

Professor Chen has had many outstanding achievements. In his academic career, he was a renowned economist who focused on economic development and regional economic cooperation. He is also a born teacher. Before joining HKU SPACE, Professor

Chen championed the development of a liberal arts education when he was the President of Lingnan College. He was also a Member of the Executive Council and the Legislative Council of Hong Kong.

In this AoF’s Interview Series, Professor Chen shares his views on the following areas:

Events

Collaborative Events

Banking Talent Programme

Webinar - "Asset Management Industry: Interaction with Other Financial Services Segments and Opportunities"

The AoF and the HKMA co-hosted a webinar under the professional training series of the Banking Talent Programme on 8 November 2021, featuring Ms Janet Li, Wealth Business Leader of Asia, Mercer Investment (HK) Limited. During the webinar,

Ms Li gave an overview of the asset management industry and shared her insights on business and career opportunities of the industry.

Asian Insurance Forum 2021

Panel Discussion - "Shaping Fintech up for the New Normal"

The AoF and the IA co-organised a panel discussion titled “Shaping Fintech up for the New Normal” at the Asian Insurance Forum (AIF) on 7 December 2021. The AIF is the annual flagship event of the Insurance Authority, connecting financial

regulators, industry leaders, academics and professionals in the insurance industry to exchange views on development prospects and opportunities in the Asian insurance market. Speakers shared their experience in fintech adoption and

investment, in order to inspire insurance practitioners in speeding up the adoption of Insurtech.

To watch the video of AIF 2021 panel discussion

To watch the video of AIF 2021 panel discussion

AoF-CSC Joint Seminar

Leveraging on Hong Kong's Competitive Edge as an International Financial Centre

On 16 December 2021, the AoF and the Civil Service College co-organised a seminar titled “Leveraging on Hong Kong’s Competitive Edge as an International Financial Centre” as one of the inaugural events of the Civil Service College of the

HKSAR. During the seminar, Mr Darryl Chan, Executive Director (External) of HKMA gave an overview on the recent developments in Hong Kong’s financial services industry, followed by a panel discussion moderated by Mr Kwok-chuen Kwok,

Chief Executive Officer of Hong Kong Academy of Finance. The panel discussed the future of Hong Kong’s economy, growth prospects, as well as opportunities and challenges Hong Kong faces as an international financial centre.

Events

HKIMR Disseminating its Research Report

Panel Session at Hong Kong Fintech Week 2021

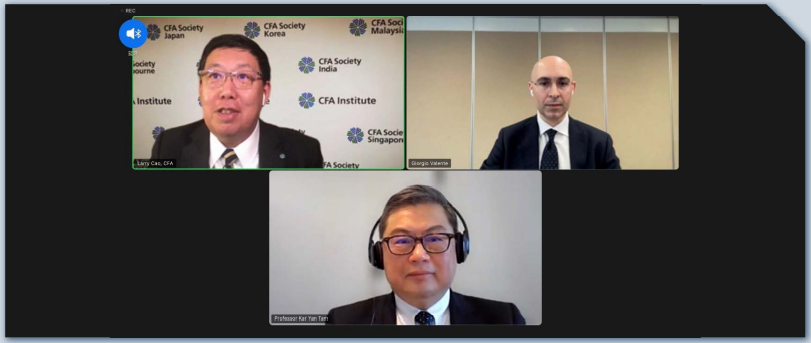

At the Hong Kong Fintech Week 2021, Dr Giorgio Valente, Head of the Hong Kong Institute for Monetary and Financial Research (HKIMR), together with Mr Larry Cao, Senior Director of the CFA Institute, Professor Kar Yan Tam, Dean of the HKUST

Business School and Prof Lapman Lee, Professor of Practice of the Hong Kong Polytechnic University, discussed the latest HKIMR report on Artificial Intelligence and Big Data in the Financial Services Industry and shared insightful

views on talent flows and strategies for talent development.

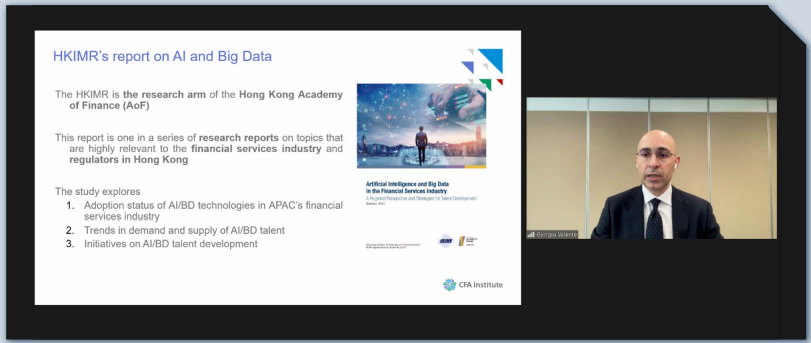

Webinar by the CFA Institute - AI and Big Data Adoption in APAC Financial Services and Strategies for Talent Development

The HKIMR report on Artificial Intelligence and Big Data in the Financial Services Industry was also shared by Dr Valente, Mr Cao, and Professor Tam in a webinar organised by the CFA Institute in December 2021. The event was attended

by CFA charter holders in the APAC region and the video recording has been further disseminated in other regions worldwide.

To watch the recording of the webinar

To watch the recording of the webinar

Research

Applied Research

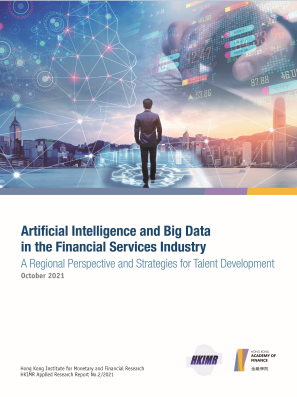

The HKIMR released a new Applied Research report on Artificial Intelligence and Big Data in the Financial Services Industry: A Regional Perspective and Strategies for Talent Development in October 2021.

The key takeaways of the report are:

- 71% of the survey respondents across financial sectors in the Asia-Pacific region have either adopted or planned to adopt AI/BD technologies in the next 12 months;

- Market participants see clear benefits from AI/BD adoption, but they also highlight that the shortage of talent is one of the key challenges now and in the next 5 years;

- Professionals with both finance and AI/BD skills will be in demand over the next 2 years, with 85% of AI/BD

professionals currently employed in non-financial

sectors;

- While all financial centres in the region experienced net inflows of AI/BD talent during the past year, talent gaps are still present; and

- Strategies to narrow the existing talent gap and support talent recruitment are key to developing a critical mass of professionals that can support further AI/BD adoption in Hong Kong’s financial

services industry.

The full report can be viewed here.

To watch the video clip of a summary of the report

To watch the video clip of a summary of the report

Research

Monetary Research

Since last Septmeber, the HKIMR has published the following studies on relevant topics in monetary and financial economics:

Rise of Bank Competition: Evidence from Banking Deregulation in China

(by Haoyu Gao, Hong Ru, Robert Townsend and Xiaoguang Yang)

Effect of Climate-Related Risk on the Pricing of Bank Loans: Evidence from Syndicated Loan Markets in Asia Pacific

(by Kelvin Ho and Andrew Wong)

On the Geographical Dispersion of Euro Currency Trading: An Analysis of the First 20 Years and a Comparison to the RMB

(by Frank Westermann)

Is the Renminbi a Safe-Haven Currency? Evidence from Conditional

Coskewness and Cokurtosis

(by Xin Cheng, Hongyi Chen and Yinggang Zhou)

Published in Journal of International Money and Finance, Volume 113, January 2021, Article 102359

Household Indebtedness and the Consumption Channel of Monetary Policy: Evidence from China

(by Michael Funke, Xiang Li and Doudou Zhong)

Payments on Digital Platforms: Resiliency, Interoperability, and Welfare

(by Jonathan Chiu and Tsz-Nga Wong)

Accepted by the Journal of Economic Dynamics and Control

The Design of a Central Counterparty

(by John Kuong and Vincent Maurin)

Market-Friendly Central Bankers and the Signal Value of Prices

(by Prasanna Gai, Edmund Lou and Sherry X. Wu)

The Rise of China’s Service Sector

(by Chong-En Bai, Xilu Chen, Zheng (Michael) Song and Xin Wang)

All HKIMR working papers can be viewed here.

Research Seminars/Webinars

HKIMR Webinar – “Household Indebtedness and the Consumption Channel of Monetary Policy: Evidence from China” on 8 October 2021 by Michael Funke, Hamburg

2021 is coming to a close and I am glad to report that the AoF has had a very fruitful year, thanks to your support and participation. Our leadership development and research efforts have focused on and made contributions to key contemporary developments in the financial sector, including fintech and digitalisation, green finance and ESG, and GBA and China. We have also expanded significantly the reach of our events and reports, not only to many more senior executives in the local financial sector, but also to stakeholders outside of Hong Kong, including regional central banks and the audience in Mainland China. The webinar on the RMB exchange rate in August, for example, attracted over 1.16 million viewers and has set a new benchmark for our future efforts in increasing our impact and promoting our brand.

2021 is coming to a close and I am glad to report that the AoF has had a very fruitful year, thanks to your support and participation. Our leadership development and research efforts have focused on and made contributions to key contemporary developments in the financial sector, including fintech and digitalisation, green finance and ESG, and GBA and China. We have also expanded significantly the reach of our events and reports, not only to many more senior executives in the local financial sector, but also to stakeholders outside of Hong Kong, including regional central banks and the audience in Mainland China. The webinar on the RMB exchange rate in August, for example, attracted over 1.16 million viewers and has set a new benchmark for our future efforts in increasing our impact and promoting our brand.

The Hong Kong Institute for Monetary and Financial Research (HKIMR) successfully hosted the Eleventh Annual

International Conference on the Chinese Economy (the Conference) on 11 November. Over 3,000 people participated, both online and offline, including many from central banks, international financial institutions, the financial sector,

the academia, and professional institutions.

The Hong Kong Institute for Monetary and Financial Research (HKIMR) successfully hosted the Eleventh Annual

International Conference on the Chinese Economy (the Conference) on 11 November. Over 3,000 people participated, both online and offline, including many from central banks, international financial institutions, the financial sector,

the academia, and professional institutions. During his keynote speech, Mr Long Guoqiang, Vice President of the Development Research Center of the State

Council, elaborated on the policy of common prosperity in depth. He also had a candid conversation with participants on the latest development of the property sector in China.

During his keynote speech, Mr Long Guoqiang, Vice President of the Development Research Center of the State

Council, elaborated on the policy of common prosperity in depth. He also had a candid conversation with participants on the latest development of the property sector in China.

TOP

TOP