Message from CEO

Further to our efforts to increase the number of “Friends of AoF” as explained in the June Newsletter, the Hong Kong Academy of Finance (AoF) made significant breakthroughs in July-September in reaching out to a much broader spectrum of stakeholders in Hong Kong and across Asia.

Further to our efforts to increase the number of “Friends of AoF” as explained in the June Newsletter, the Hong Kong Academy of Finance (AoF) made significant breakthroughs in July-September in reaching out to a much broader spectrum of stakeholders in Hong Kong and across Asia.

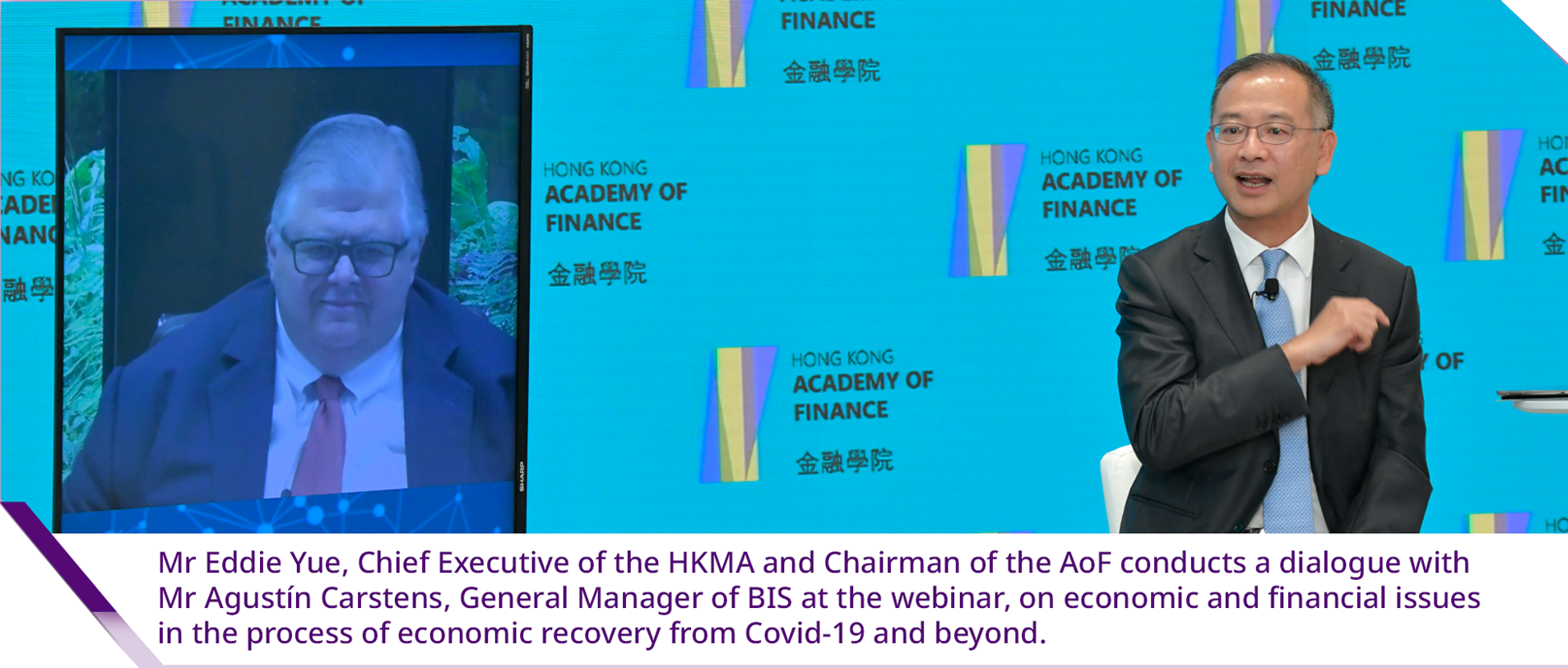

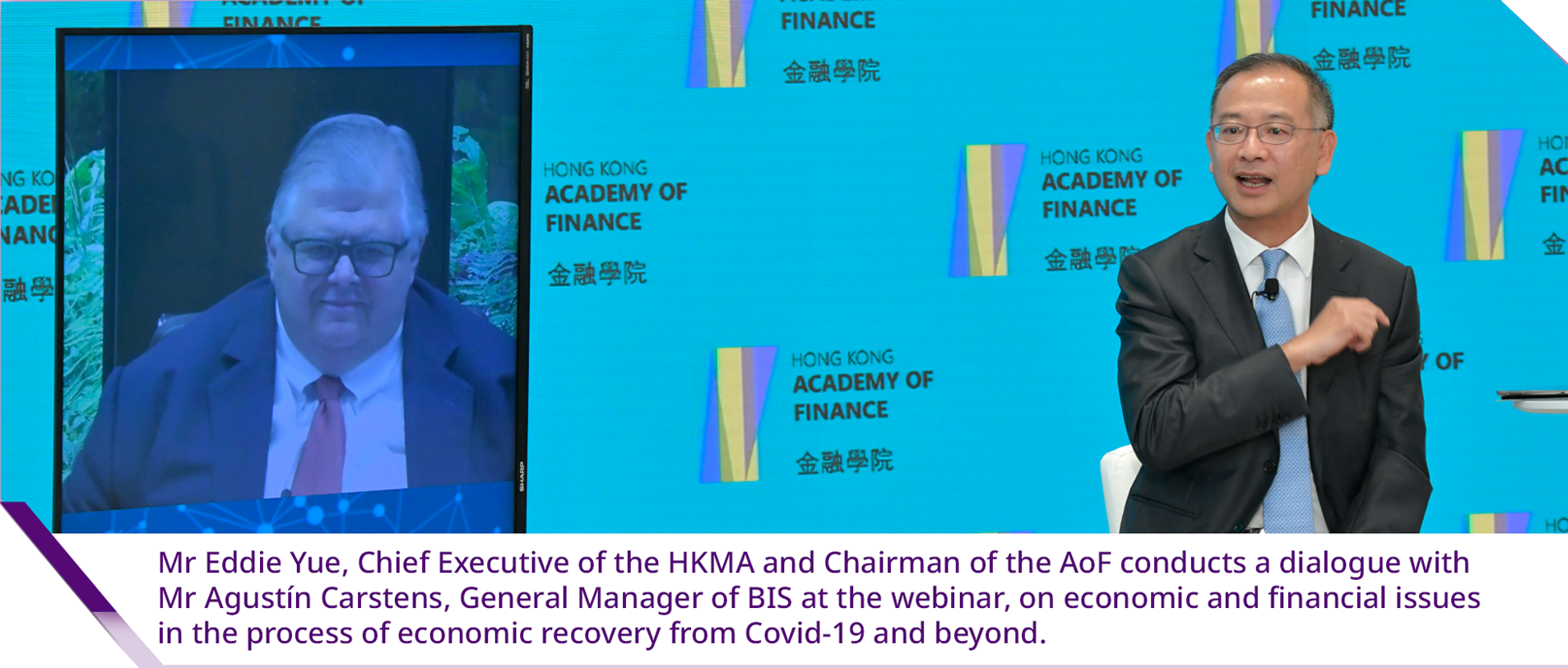

The Dialogue we co-organised with the Bank for International Settlements (BIS) in July attracted over 270 real time viewers and about 1,000 views on YouTube. These include many friends from central banks across the Asia-Pacific region. The AoF X HKU Business School Joint Seminar had an audience of 410, many of whom were HKU students and alumni.

The AoF-HKIMR event on RMB exchange rate in August was broadcasted live on Bloomberg and a number of financial platforms in Mainland China, attracting around 1.16 million real time participants from Hong Kong, Mainland China and overseas. The video recording of this event posted on the AoF website and YouTube has so far attracted over 14,000 views. The China Construction Bank Hong Kong Training Centre live-streamed the event on its portal and got 327 real time views and 160 views of the video recording.

Meanwhile, we are gradually stepping up our communication and branding efforts. Apart from posting more actively our events on our LinkedIn page, we have upgraded our YouTube channel, the AoF website and this Newsletter to make them more user- and share-friendly.

Through promoting participation in AoF activities, collaboration with other organisations, leveraging on our digital capabilities and more active use of social media, the AoF and the HKIMR are not only reaching out to more stakeholders within and outside of Hong Kong, but also gradually building up a brand name as reputable platforms for thought leadership and knowledge exchange on important economic and financial issues, particularly those related to Hong Kong, Mainland China and the Asia-Pacific region.

Looking ahead into the fourth quarter, a major event will be the HKIMR’s flagship event, the “Annual International Conference on the Chinese Economy”, scheduled on 11 November, 2021. This will be a unique opportunity for our Members to understand more about latest developments related to ‘common prosperity’, regulatory policies, property market and financial market stability, financial liberalization in GBA and other subjects. Stay tuned.

Kwok-chuen Kwok

CEO, Hong Kong Academy of Finance Limited

Leadership Development

Hong Kong welcomes the BIS to

step up its collaboration with Asia

In an event hosted by the AoF to launch the BIS Annual Economic Report (AER) in Asia, Mr Agustín Carstens, General Manager of the BIS, said that “Asia continues to demonstrate its resilience and economic dynamism, amidst an increasingly uncertain global outlook, as indicated in our AER. Hong Kong and the region are often at the front line of technological and policy innovations. BIS has benefited from close collaborations with central banks in Asia throughout the years and looks forward to a stronger partnership in the period ahead.” Mr Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (HKMA), who had a dialogue with Mr Carstens on a range  of financial market issues during the event said that “Throughout the Covid-19 pandemic, the BIS as the premier global forum for central banks has contributed significantly to the coordination of policies and the exchange of views, especially through the most trying times in financial markets.” The Financial Secretary, Mr Paul Chan, said that he welcomes the BIS to step up its collaboration efforts with central banks in Asia.

of financial market issues during the event said that “Throughout the Covid-19 pandemic, the BIS as the premier global forum for central banks has contributed significantly to the coordination of policies and the exchange of views, especially through the most trying times in financial markets.” The Financial Secretary, Mr Paul Chan, said that he welcomes the BIS to step up its collaboration efforts with central banks in Asia.

Research

Monetary Research

Since last June, the HKIMR has published the following studies on relevant topics in monetary and financial economics:

Excess Labor Supply, Structural Change and Real Exchange Rate

(by Jiandong Ju, Justin Yifu Lin, Qing Liu and Kang Shi)

Dissecting the Segmentation of China’s Repo Markets

(by Xiaoqing Eleanor Xu)

What Goes Around Comes Around: How Large Are Spillbacks from US Monetary Policy?

(by Max Breitenlechner, Georgios Georgiadis and Ben Schumann)

Global Trade Slowdown in the 2010s: Sign of Deglobalisation?

(by Edmund Ho-Cheung Ho)

Are Government Bond Yields Bounded or Quasi-bounded at the Zero? – Credibility of Central Banks' Commitments

(by Cho-Hoi Hui, Chi-Fai Lo and Ho-Yan Ip)

The Real Effects of Low-for-long Interest Rates on Mainland Firms Listed in Hong Kong

(by Shuang Jin)

A Model of Structural Transformation and Demographic Transition in China and Dynamics of World Interest Rate

(by Gaofeng Han)

All HKIMR working papers can be viewed here

Applied and Monetary Research Seminars/Webinars

7 webinars on applied and monetary research studies were organized. They covered a wide range of macro and financial economics topics as well as recent developments in financial markets provided by experts in the various fields.

HKIMR Webinar - “Big Techs VS Banks” on 8 June 2021 by Bruno M. Parigi, University of Padova

HKIMR Webinar - “Market-Friendly Central Bankers and the Signal Value of Prices” on 6 August 2021 by Prasanna Gai, University of Auckland

HKIMR Webinar - “The Term Structure of CIP Violations” on 29 June 2021 by Patrick Augustin, McGill University

HKIMR Webinar – “The Design of a Central Counterparty” on 26 August 2021 by John Kuong, INSEAD Business School

HKIMR Webinar - “Swap Volatility Dynamics and the Transmission of Systematic Risk in Hong Kong” on 23 July 2021 by Paul D. McNelis, Fordham University

HKIMR Webinar – “Payments on Digital Platforms: Resiliency, Interoperability and Welfare” on 10 September 2021 by Jonathan Chiu, Bank of Canada

HKIMR Seminar - “ETF Mispricing Comovement” on 4 August 2021 by Frank Li Weikai, Singapore Management University

Further to our efforts to increase the number of “Friends of AoF” as explained in the June Newsletter, the Hong Kong Academy of Finance (AoF) made significant breakthroughs in July-September in reaching out to a much broader spectrum of stakeholders in Hong Kong and across Asia.

Further to our efforts to increase the number of “Friends of AoF” as explained in the June Newsletter, the Hong Kong Academy of Finance (AoF) made significant breakthroughs in July-September in reaching out to a much broader spectrum of stakeholders in Hong Kong and across Asia.

of financial market issues during the event said that “Throughout the Covid-19 pandemic, the BIS as the premier global forum for central banks has contributed significantly to the coordination of policies and the exchange of views, especially through the most trying times in financial markets.” The Financial Secretary, Mr Paul Chan, said that he welcomes the BIS to step up its collaboration efforts with central banks in Asia.

of financial market issues during the event said that “Throughout the Covid-19 pandemic, the BIS as the premier global forum for central banks has contributed significantly to the coordination of policies and the exchange of views, especially through the most trying times in financial markets.” The Financial Secretary, Mr Paul Chan, said that he welcomes the BIS to step up its collaboration efforts with central banks in Asia.

TOP

TOP